Warranty Certificates for Your Business

When a customer purchases your product,they want to be reassured that they made the best decision. Part of that reassurance comes from a warranty certificate that you provide them. The custom warranty certificate is confirmation that in the event that your product fails to deliver as promised,your customer can reach out to you for resolution.

Why are warranty certificates so important?

A warranty certificate is a critical document because,without it,your customer will not be able to make a claim for a repair or replacement. Therefore,a warranty certificate must contain wording that outlines your company’s terms and conditions,which includes the warranty period and other important information. Here are a few examples of custom warranty certificates that you can create,print and email with SimpleCert®.

5 Types of Warranty Certificates

Product Warranty Certificate

Product Warranty Certificate A product warranty certificate is probably one of the simplest of warranty certificate options. It contains clear language that includes product terms and conditions,warranty period,the limitation of warranty,and other important information that can be customized to your specific needs.

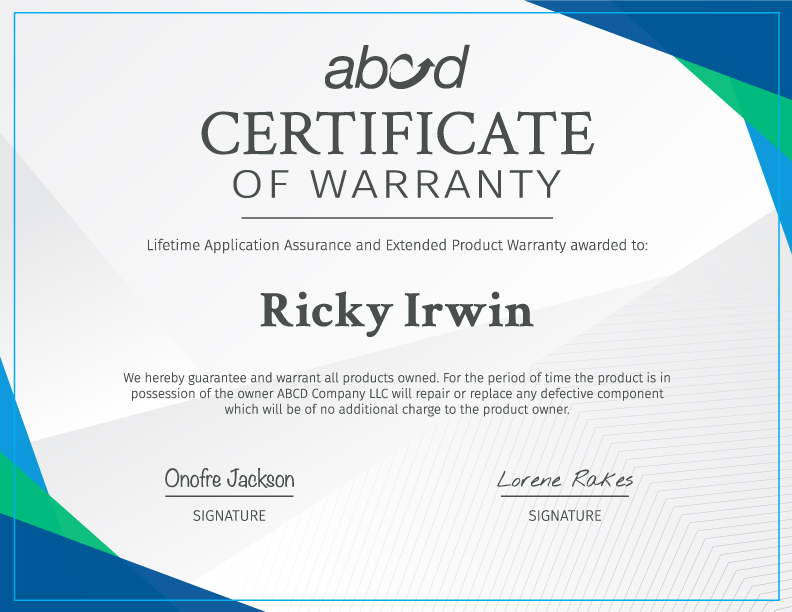

Extended Warranty Certificate

With an extended warranty certificate,the most obvious benefit is your customer’s peace of mind. The extended warranty requires a customer to pay in addition to the cost of your product but the knowledge that if there is a repair needed down the road outweighs the cost of the extended warranty.

Lifetime Warranty Certificate

This warranty certificate is the “granddaddy” of them all. BY giving your customers this certificate,you are giving them a reason to trust in the quality and lifespan of the product they purchased. There are some subtle nuances as to what “lifetime” means,however,and that will be something that you and your company will need to define.

Limited Warranty Certificate

A limited warranty certificate applies to specific aspects of your product,certain types of product defects or any other conditions that you place on the product. This could include covering just parts,splitting the cost of the repair with the customer and more options.

Certificate of Authenticity

This certificate is vital when the product in question needs to be authenticated as real. Being able to provide your customer with a product authenticity certificate is what ensures that you and your business are credible and your customer has a genuine product.

With SimpleCert®,you can build professional warranty certificates that cover all the details of your product and its warranty information for any situation or type of coverage you may need. You can choose from basic templates that do the job or choose from dozens of templates for PC or Mac. You can add your branding and other personalization that will instill confidence and trust when providing them to your customers.

How To Use the SimpleCert® Platform to Create Printable Warranties

Ready to get started with SimpleCert® and want to know how much it will cost? That’s easy nothing! You can sign up for SimpleCert® completely free,with no credit card required. Free users can create,print and send up to 10 warranty certificates per month.

Once you’ve created your account,you’ll enter the SimpleCert® design studio where you can choose from a vast library of prebuilt certificate templates,or create your own from scratch. You can add your own custom artwork or company logo,and browse an online library of thousands of photos,graphics and icons to make your certificate truly one of a kind.

After you’re done designing your warranty certificate you’ll have the option to save,print,send and store. If you’re using your template to print certificates for one or a few recipients,the process is fairly straightforward. Certificates are saved as PDFs,which can then be printed or emailed directly from the SimpleCert® online system.

For businesses who want to send a warranty certificate to multiple recipients,you can use our bulk certificate API,Zapier connection or Google Forms to upload a list of recipients which will then be automatically mapped to your template. You can then use the SimpleCert® send tool to dispatch your certificates via email.

Our help center is also a great resource for businesses and individuals looking to get the most out of their SimpleCert® experience.

Did we mention that it’s totally free to get started? There simply isn’t a better or more convenient way to create printable certificates that can be used offline,online or anywhere you wish! Be sure to check out the link below to get started.